These Charts Show That China May Be Headed For A Financial Crisis

BEIJING There have been mounting concerns among China watchers about a debt bubblegrowing and possibly bursting.As China has the second largest economy in the world, a Chinese financial crisis would significantly affect a globalized world economy. Beijing argues the problem is manageable but newdatashows a dangerous increase in the number of new loans issued in China: 16 percent more in the fourth quarter of 2016 than the third quarter and 26 percent more in the fourth quarter of 2015 than that of 2016.

In 2016, credit expanded to 16 percent more than in 2015, and total debt grew nearly 2.4 times Chinas GDP. Taken together, this is a warning sign of a potential crisis.

This continues a trend of an unprecedented increase in the level of debt in the Chinese economy over the past five years. Debt in the non-financial sector has increased by 74.4 percent over the past five years, compared to only 8.6 percent over the eight years before the financial crisis, from 2000 to 2008.

This increase has been driven in part by the Chinese governments efforts to meet the annual growth target of 6.5 to 7 percent that was the centerpiece of the Communist Partys five-year plan for the years 2015 to 2020. This target could be too high, as China transitions from an export-oriented economy to a consumer-driven one. With the normal economy unable to deliver, the government has promoted credit growth to prop up short-term growth rates. Similar fast credit growth has played a key role in past financial crises, such as the recent U.S. financial crisis and Japans lost decade.

Chinas banking sector is experiencing a very high level of what are called non-performing loans. China has a large number of loans that have been overdue for more than 90 days. Official statistics estimate this figure to be around 2 percent of all loans outstanding. But third-party estimates from Fitch and Credit Lyonnais Securities Asia are higher between 15 to 20 percent of all loans outstanding which would put China in the company of countries such as Italy, which is currently bailing out its banks. A high number of NPLs is caused by the Chinese economys poor underlying performance, as well as by poor credit decisions, like extending credit at too fast a pace.

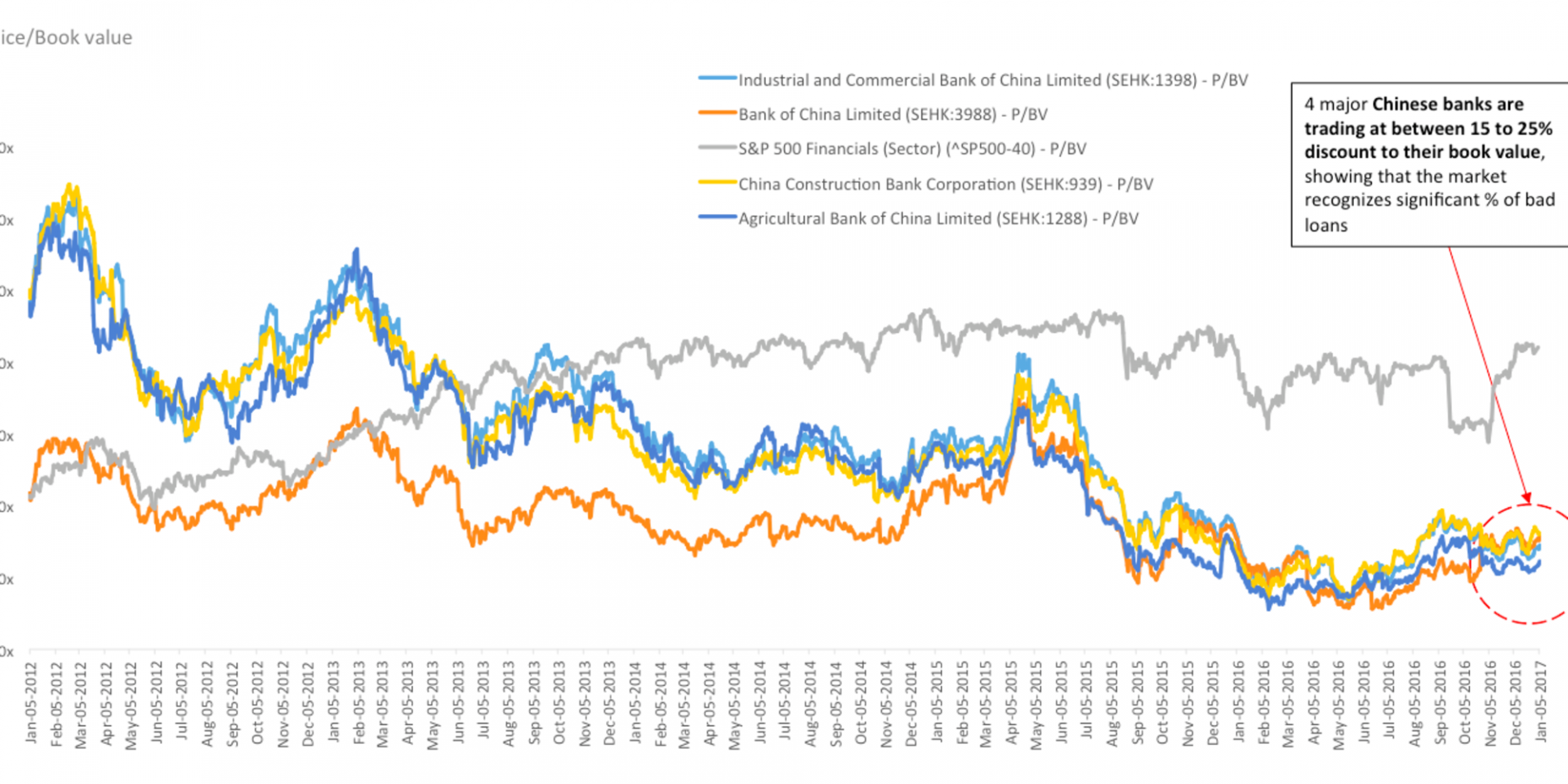

Could it be possible that the third-party estimates of Chinas high number of NPLs are significantly off the mark? This seems unlikely. The higher estimates seem to be reflected in the stock market prices of the largest Chinese banks, which are trading at a discount of between 15 to 25 percent from their book value, compared to their long-term average of trading at around a 20 percent premium.

The price-to-book value is a commonly used metric to see how bullish or bearish the market is about the valuation of banks. A bank that correctly reported its NPLs would have to take a write-down to its book value to reflect the lower likelihood of repayment of these loans.

The market is essentially performing the same function by applying a discount to their book value. Therefore, the market seems to recognize a significantly higher degree of NPLs than what the Chinese banks are currently reporting. In comparison, U.S. financial stocks are trading at around a 30 percent premium to their book value.

At the same time, however, China enjoys some unique features that make it less prone to a banking crisis, including a closed capital account, a high saving rate and firm control on the real estate market. A closed capital account makes it difficult for Chinese citizens to take their money out of China and therefore necessitates them keeping their money in Chinese banks. A high savings rate enables China to sustain a higher steady state level of debt, which is also seen in countries like Japan. And by successfully controlling factors such as the supply of new land, mortgages policies and housing purchase criteria, a possible bubble in property prices, spotted as early as 2005, has not yet burst.

Most importantly, the Chinese government backstops the entire banking sector. Therefore, most Chinese citizens assume that the only risk they face is sovereign risk. Furthermore, the Chinese government appears to have the fiscal space to bail out its banking sector: the total debt of the Chinese government is comparatively low, around 45 percent of GDP, compared to U.S. government debt that is at 103 percent of GDP.

But even with these safeguards, Chinas banking sector faces increasing risks; a crisis could be triggered by unfavorable or unforeseen events. For example, significant capital flight from China, due to an increase in interest rates by the U.S. Federal Reserve, could spark a liquidity crisis. Or a significant drop in real estate prices could increase non-performing loans to an unsustainable level. Lastly, further slowdown in the Chinese economy say around 4 percent could also further increase non-performing loans that are typically a function of business cycles.

How costly could this be to the Chinese government? Let us assume that the banking sector recognizes the 15 to 20 percent of non-performing loans explicitly and forces a government bailout. The average recovery rate that the Chinese government was able to obtain on these loans in its previous banking crisis was between 30 and 40 percent. Assume that we were to get a similar rate today, and multiply that by Chinas current debt level of around 250 percent. We see that the cost could be between 23 and 35 percent of GDP in other words, between$2.5 and $4 trillion.

This is in line with estimates of what it cost the Chinese government in the 1999 bailout, which was between 22 and 28 percent of GDP. The bailout would cause credit supply to temporarily freeze, which would negatively impact the real economy and further increase NPLs. Therefore, the potential costs of this are, in fact, much higher.

The governments current strategy seems to be to double down on credit growth in order to improve GDP growth and thereby hopefully grow out of its large amount of non-performing loans. But this is a bet and a risky one at that.