How to own a home by the age of 25 – BBC News

Image copyright Mark Hepburn

Image copyright Mark Hepburn Owning a home by the age of 25 has become an unachievable dream for many over the last two decades.

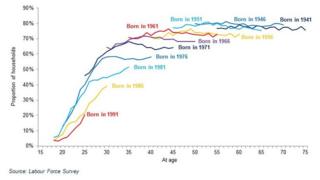

Soaring property prices mean just one in five 25-year-olds own a property, compared to nearly half two decades ago, according to one recent study.

But as the government prepares to unveil its Housing White Paper, a there are some young people who have managed to buck the trend – without help from the bank of mum and dad.

Here four young homeowners – all couples – who bought properties in 2016 – reveal just how they did it.

Mark and Laura

Name: Mark Hepburn, age 23. A debt collector on 18,500 a year

Lives with: Partner Laura Starkie, age 25. An accountant on 20,000 a year

Location: Oldham, Greater Manchester

House price: 125,000 for a three bedroom semi-detached house

Deposit: 6,250 (5%) with the Help to Buy mortgage scheme (which ended in December)

Why buy a property?

We were sick of living at home with each of our parents and wanted our own space. I’d rather live in a house than just a bedroom. We discussed moving out and renting, but we both agreed it was dead money.

How did you do it?

There was a lot of budgeting. I literally know where every penny goes. I had to drill it into Laura a little bit, but she got used to it after a while. Like her make-up – she had to go for a cheaper brand. We were both working at McDonald’s when we were saving and if there were extra shifts, we would take them.

Image copyright Mark Hepburn

Image copyright Mark Hepburn Did you make any sacrifices?

There was definitely a lifestyle change when we were saving. We would buy supermarket budget stuff instead of brands. We didn’t go on holiday during the time we were saving up – and that was a massive thing for Laura.

How does it feel to be a home owner?

I feel ridiculously happy. I feel proud and our friends are too because they know we worked extremely hard for it. Once you get there, you don’t need to worry as much.

What if you need to move?

I recently went for a job in Bolton, which is not that close to where we are now. The salary was 27,000 per year, but I wouldn’t move house for that. It would have to be significantly higher to consider jobs away from where we are now.

Image copyright Mark Hepburn

Image copyright Mark Hepburn Reaction from friends?

I can’t count how many times our friends have asked us how we’ve done it. We just explain you need to save, watch your money and cut back. They’re happy for us and we are just trying to get it into them not to leave it too long and to start saving.

Should more young people be able to buy a home?

I have got mixed opinions. When Laura and I were at McDonald’s we were on a combined salary of 23,000 and we managed to save up 7,000 between us within a year. So I don’t see how people can’t do it. But then we don’t have any kids. The Help to Buy mortgage scheme was a God-send. But if you’re stopping something that’s so good and helping young people, it’s going to cause mayhem.

Ruby and Sam

Image copyright Ruby Willard

Image copyright Ruby Willard Name: Ruby Willard, age 22. A recruitment consultant on 19,000 a year plus commission

Lives with: Partner Sam Bardell, age 22. An engineer on 24,000 a year plus overtime

Location: Havant, Hampshire

House price: 182,200 for a two-bedroom terraced house

Deposit: 18,220 (10%) with the Help to Buy Isa

Why buy a property?

It was a case of living at home. I moved back into the box room of my mum’s house and I hated it. Sam lived with his parents too so we thought if we can, let’s do it – so we decided to save and go for it. We were looking at renting but to us it was like throwing away money.

How did you do it?

Being quite tight is probably the answer. When we decided we were going to buy, I thought I’m not going to spend money elsewhere when I don’t need to. We did still have a nice holiday to Greece. I get commission and Sam gets overtime so we probably earn 55,000 overall, which meant we were in a position we could borrow maybe more than people on minimum wage.

Image copyright Ruby Willard

Image copyright Ruby Willard Did you make any sacrifices?

We may have not had such a big social life. We still did things, but we were conscious. What I did was save what I knew I needed to save, and lived on whatever I had left – which was usually about 200 a month. I wasn’t buying lunch at work, which would save about 25 a week.

How does it feel to be a home owner?

It was weird at first. When we got the keys it was like “are we on holiday?” When things started to come together it felt like such an achievement. Everything we had chosen not to do, not going to the cinema one night, helped towards it.

What if you need to move?

We would be open to the idea, but we would probably look for work closer to where we bought a house, so it probably would affect future decisions. If we did decide we wanted to go somewhere else, we would probably look to sell the house and hopefully we will have made some money on it.

Image copyright Ruby Willard

Image copyright Ruby Willard Reaction from friends?

It’s been quite positive. I have got friends that have bought houses, but a lot of them have had big lump sums of money given to them.

Should more young people be able to buy a home?

Neither of us completed three years at university, so we probably established a career path earlier than those that do go. I speak to a lot of people that have graduated, and they cannot find jobs that will allow them to borrow enough. It takes years to save a deposit, and then house prices go up and they can’t borrow enough. I think this is how it is now.

Andrew and Kirsty

Image copyright Andrew Douglas

Image copyright Andrew Douglas Name: Andrew Douglas, age 23. A social worker on 31,000 a year

Lives with: Partner Kirsty Lamb, age 24. A pharmacist on 35,000 a year

Location: Moredun, Edinburgh.

House price: 145,000 for a two-storey terraced house with two bedrooms

Deposit: 21,750 (15%) with the Help to Buy Isa

Why buy a property?

We decided we wanted to get on the property ladder as quickly as possible. If we get on it now, we would be able to buy what we want by the time we are older and looking to have a family.

How did you do it?

We started saving at the beginning of 2015 and were probably saving between 400 and 500 a month each. We did go on a couple of holidays, so although we’ve been saving, we’ve still been living. We weren’t scrimping, but we do only spend about 30 a week on food. We check receipts and look for the best deals, so that is more thrifty than most people.

Image copyright Andrew Douglas

Image copyright Andrew Douglas Did you make any sacrifices?

We spoke about going away for three weeks to somewhere like Australia, but we thought – it’s going to cost 2,000 each and we can put that towards the house now rather than waiting a few extra months.

How does it feel to be a home owner?

It feels strange. It does feel like quite a lot of responsibility – I didn’t realise how much. Things like taking out mortgage protection. Our friends call it “adulting hard”. They’re renting and not really thinking about owning a place and they’re like “wow, you’ve bought a house”.

Reaction from friends?

Lots of people think it’s really good, other people say they’re nowhere near that stage. I don’t know if they’re thinking I’m growing up too fast. It’s generally been positive. I don’t know anyone who has done it without a partner, so I think it would be difficult to do it on your own.

Image copyright Andrew Douglas

Image copyright Andrew Douglas What if you need to move?

With a big move we might give it a trial, and rent out this house while we lived somewhere else.

Should more young people be able to buy a home?

I do think people complain they can’t afford to buy a house but they go out every weekend, they smoke or they eat out all the time. But property prices have also shot up in the last 20 years with more people buying second homes. There are also people who don’t want to have the responsibility. I think it’s good that the government is helping with Help to Buy schemes and it needs to do more to help first-time buyers.

Rebecca and Adam

Image copyright Rebecca Thompson

Image copyright Rebecca Thompson Name: Rebecca Thompson, aged 23. An information analyst on 21,900 a year.

Lives with: Adam Drinkwater, aged 25. A bank administrator on 16,500 a year.

Location: Irlam, Greater Manchester

House price: 126,500 for a three-bedroom semi-detached house

Deposit: 6,300 (5%) with the Help to Buy mortgage scheme and Isa

Why buy a property?

We lived in a rental flat together for 18 months and realised that the amount we were paying in rent was more or less the same as we would be paying with a mortgage. When we were renting there were a lot of things we couldn’t do, like decorate or move anything around.

How did you do it?

It was difficult. I was working part-time in my final year at university so I saved my entire wage and lived off my student loan, which wasn’t much. We didn’t go on holiday that year and saved as much as we could.

Image copyright Rebecca Thompson

Image copyright Rebecca Thompson Did you make any sacrifices?

We came straight from university, where you’re living on a bit of a shoe-string anyway, so we probably sacrificed but not realised, because we’ve not been enjoying the extra income we’ve had since graduating. We would have probably gone on some more holidays or gone out more and probably bought a few more clothes.

How does it feel to be a home owner?

It’s brilliant. I feel it’s a really secure base while I’m going on to develop my career. It’s one less thing. A lot of people are aiming towards saving a deposit while I’ve got past it.

What if you need to move?

It would be really difficult, and it’s definitely an attraction for staying where I am. In my career there are a lot of opportunities down south, but I wouldn’t want to entertain it because of the house prices. It would take us five times longer to save up a deposit, and the amount of income you need to get for a mortgage is totally unobtainable for the average graduate.

Image copyright Rebecca Thompson

Image copyright Rebecca Thompson Reaction from friends?

Some live in a more expensive area and I think they were surprised. It’s not something that’s on a lot of people’s radar, owning a home at this age. Particularly if you’re not in a relationship, I don’t think it is affordable.

Should more young people be able to buy a home?

I think cultures have changed a bit. When my parents were growing up, their parents drilled into them ‘sort yourself a house, get married and that’s when your life begins’. Now there’s not as much of an emphasis. I think homes do need to be more affordable. It’s silly that the town where we live in, a lot people can afford to buy – whereas only as far south as Birmingham no-one can afford to buy a house earning what we do.

First-time buyers: The numbers

Image copyright Local Goverment Association

Image copyright Local Goverment Association - The average age of a first-time buyer in the UK is 30, says lender Halifax

- The deposit paid by first-time buyers was on average more than 20% of the property price in 2014

- The cost of a home for a first-time buyer was 4.5 times their annual income in 2014

- The median income for a first-time buyer household in England was 43,000 in 2014/15 – 16,000 more than all households

- Nearly a third had help from friends and family for their deposit

- The average price of a UK home was 217,928 in November 2016 – 6.7% higher than the previous year

Source: ONS, Department for Communities and Local Government, Land Registry

Read more: http://www.bbc.co.uk/news/uk-38564137