Financing growth with debt in the app economy

When it comes to obtaining financing to grow your app or game business, there are several options from which to choose that take a debt-based approach, rather than giving away equity in your business. Choosing the right type of financing is critical; making the wrong choice can be costly in both financial and non-financial terms.

Smart developers consider accounts receivable (AR) financing or venture debt as suitable sources of financing because they are generally low cost and dont dilute their equity. However, many often dont read the fine print, which can lead to them signing away more than they need to. So how can you avoid this increasingly common pitfall?

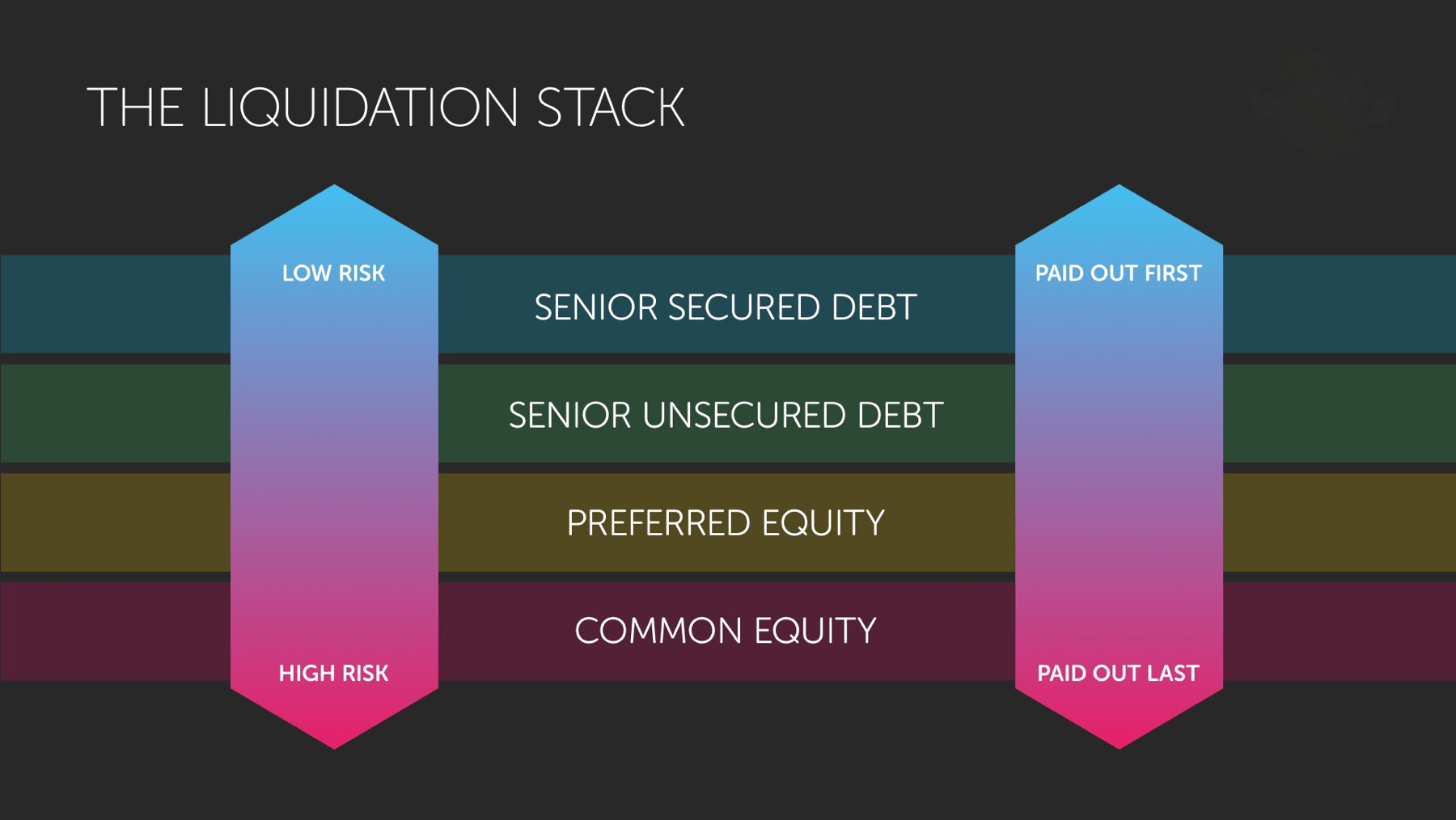

Understanding liquidation preference

One of the keys to making the right financing choice is understanding the concept of liquidation preferences. When lending money, banks or venture debt providers will require you to pledge certain assets as security against the funds advanced. This is known in the U.S. as a lien (or a charge in the U.K.). Liquidation preference determines which creditors are paid out first if your company ends up in financial difficulties and goes into receivership.

In order to get paid in the event of insolvency, creditors must have a valid and properly secured interest in a specific business asset or assets. But these interests are not all equal. Typically, the ranking order of liquidation preference is as follows:

- Senior secured debt: i.e. where there are liens over specific assets

- Senior unsecured debt: loans made to a company without a specific security interest

- Preferred equity: typically VC funds that get paid out first in a distribution, up to the point of the preference rights negotiated

- Common equity: typically founders, angels and employees

Source: Pollen VC

When considering debt financing for your app business, its critical that you understand this order of liquidation preference. You also need to understand the specific assets you are pledging as security for your loan because creditors holding liens on specific assets have liquidation preference over other creditors. This means that they get paid out first in the event of an insolvency situation. And once assets have been pledged as security to one lender, they cant be pledged again to another lender.

The assets you pledge as security should be appropriate for how youre going to use the money you borrow.

The assets you pledge as security should be appropriate for how youre going to use the money you borrow. For example, if youre borrowing money against your receivables to fund growth, you should only secure the loan against your receivables. Generally speaking, if an asset can be clearly defined, theres no reason other assets should be included as security, although lenders will often try to include wider coverage as it improves their overall security position in the event of any default.

Heres an analogy: When you take out a mortgage to buy a home, you must pledge your home as security for the loan. But the bank doesnt ask you to also pledge other assets like your vehicles or your future earning capacity (in other words, your personal intellectual property).

Reporting and covenants

One area that often is overlooked when putting debt-based deals in place is the area of reporting and covenants (operational restrictions on running your business, like taking on other borrowings).

Depending on the sophistication of the lender, they most likely will ask for detailed financial reporting from the business in order to constantly monitor its financial health. This reporting requirement could be as often as every seven days, so startups should think through whether they have the available internal resources to produce and update these reports. The alternative is to factor in the time and costs of outsourcing this to their accountants.

The primary reason lenders look for this constant level of detailed reporting is to closely monitor the finances of the company specifically, with regard to ensuring certain covenants are not breached. They typically will focus on the level of debt within the company, ensuring there is always enough cover for the lender to be repaid. It can take the form of an absolute level or a ratio, such as the debt service coverage ratio or receivables turnover ratio that will give trackable measures of the companys ability to meet its repayments.

When things go wrong

When considering raising any form of debt, its important to always focus on the downside scenario. Lenders are wired for risk and downside, whereas early-stage companies almost by definition are focused on upside scenarios. So its important to really think through the downside scenarios and consider very carefully what security you are prepared to grant. You must protect not only company founders and management, but also your investors.

If covenants are breached, its likely that a lender will immediately call in the security they have in place in order to recover their funds. These situations can happen very quickly, with companies being forced into administration and having no time to put alternative arrangements in place or find additional investment.

The structural financing decisions you make now could have long-term ramifications on your business.

Consider a situation where the underlying health of a games company is good and a big new title is about to launch that has required significant capital investment to create. Early metrics look promising, but launch timings have run over and the company has sailed a little too close to the wind. Cash flow from their existing portfolio of apps or games has fallen short and payment on some project work had been delayed. As a result, the company breaches its debt covenants and the venture debt provider pulls the facility and calls in the security. This forces the company into receivership before it has time to secure alternative financing.

The receivers obligation is to the creditors in this case, the venture debt provider not to the venture capital equity investors. So the IP assets of the business end up in a fire sale situation in order to recover the amount of debt outstanding. Anything left over goes to the equity holders, founders and equity investors.

Ramifications of financing decisions

If you are considering raising any form of debt for your company operating in the app economy, its critical to work with a provider that intimately understands your business. For starters, you will achieve a lower cost of capital when the risks are better understood by a specialist lender. And by granting security over only the right portfolio of assets, you will not prejudice future financings.

Lenders that operate across a wider range of verticals typically do not have an intimate sector understanding, so they often look to charge higher fees and request a more all-encompassing security package to compensate.

If you need capital to help fund the growth of your app development business, be sure you understand these key financing concepts before you commit to any type of loan especially when security is involved. The structural financing decisions you make now could have long-term ramifications on your business growth potential in the future.

Read more: https://techcrunch.com/2017/02/05/financing-growth-with-debt-in-the-app-economy/