Brexit Britain: What has actually happened so far? – BBC News

Image copyright Getty Images

Image copyright Getty Images The UK may have voted on 23 June to leave the European Union but it is not yet clear what the country’s path to Brexit will actually mean.

Here we highlight the latest developments following the vote.

Economy

Image copyright Getty Images

Image copyright Getty Images Many economists prior to the referendum had been predicting an immediate and significant impact on the UK economy and consumer confidence should the country vote to leave the EU. But this has not been borne out by the figures so far.

Whatever caution businesses may be feeling when it comes to future planning, as a nation of shoppers we seem to be keeping calm and carrying on spending. The UK’s services sector saw a record rise in August, according to a closely-watched survey. The sector, which includes everything from financial services through to cafes and shops, accounts for about 80% of the UK economy.

Confidence among UK consumers also improved in August, though it remains below pre-Brexit vote levels. And this confidence is reflected in our spending patterns: UK consumers made 168 million purchases on credit cards in July – this was higher than in June and the average of the previous six months.

This continued consumer spending is also borne out by UK retail sales figures. Sales have generally been rising for the past three years, and in July they were up 5.9% on the same month last year, helped by warmer weather and the weaker pound.

While it’s true that inflation has since gone up, with the Consumer Prices Index (CPI) rising to 0.6% in July – largely due to higher fuel prices that are priced in dollars – the Office for National Statistics (ONS) says there has been “no obvious impact” on this from the vote.

A recent Markit/CIPS survey suggests that the UK’s manufacturing sector rebounded sharply in August. Reinforcing this picture of manufacturing growth, UK industrial output grew at its fastest rate for 17 years in April to June, according to the ONS.

Elsewhere, the eurozone economy is still expanding despite the supposed shock of the UK’s Brexit vote. Eurozone economic activity was at its highest for seven months in August, according to Markit.

New prime minister

Image copyright AP

Image copyright AP David Cameron – who had campaigned for Remain – announced his resignation the day after the referendum. He was replaced by Theresa May, who won the shorter-than-expected leadership contest when rival Andrea Leadsom pulled out. Boris Johnson, who led the campaign to leave the EU, was made foreign secretary with his own leadership ambitions having been thwarted by his former Vote Leave ally Michael Gove.

Mrs May’s new cabinet also includes a Secretary of State for Brexit, David Davis, and an International Trade Secretary, Liam Fox. Mr Davis, Mr Fox and Mr Johnson all campaigned for Brexit and have roles focusing on it, but are reported to have clashed over the extent of their new responsibilities.

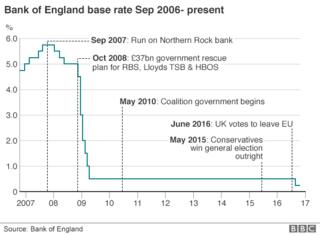

Interest rates

Since the vote the Bank of England has taken a number of steps to boost the UK economy. It has cut interest rates from 0.5% to 0.25% – it’s the first reduction in the cost of borrowing since 2009 and takes UK rates to a new record low.

The Bank has also announced a huge extension of its quantitative easing programme by an extra 70bn, and a 100bn scheme to force banks to pass on the low interest rate to households and businesses.

One effect of the interest rate cut is that it has exacerbated the growing pension funds deficit because of falling bond yields. As yields fall it reduces the incomes pension funds get from their investments.

Currency

The pound plunged dramatically on 24 June, the day after the referendum. Since then it has remained at significantly lower levels because of uncertainty about the economic outlook and the UK’s relationship with the EU, hitting a three-year low of $1.2869 on 15 August.

The currency’s continuing weakness has been accentuated by the cut in interest rates and the Bank of England’s economic stimulus measures.

Against the dollar, the pound is now worth about $1.33. A year ago it was worth $1.57 – a fall of 15%. Against the euro, it is now worth about 1.19. A year ago it was worth 1.35 – a fall of 12%.

One of the most immediate consequences of this was that it made foreign holidays more expensive for British tourists, while it has also increased import costs for manufacturers (see Trade below).

However, one beneficiary of cheaper sterling has been the UK’s own tourism sector, as a weaker pound makes Britain a cheaper destination for overseas tourists. The travel analytics firm ForwardKeys says flight bookings to the UK rose 7.1% after the vote.

Caissa Touristic, a tour operator specialising in Chinese travel to Europe, says it’s seen a 20% increase in enquiries and bookings for the UK this summer compared with the same period last year, while Irish no-frills airline Ryanair says it has seen a rise in overseas visitors travelling to London, Manchester, Liverpool, Leeds and Scotland.

Negotiations

Image copyright Getty Images

Image copyright Getty Images Mrs May has met some other EU leaders including Germany’s Angela Merkel and French president Francois Hollande, but formal negotiations on the UK’s departure from, and its future relationship with, the EU have yet to start. EU leaders have said Article 50 of the Lisbon Treaty – which sets in place a two-year exit process – must be triggered before negotiations can begin.

The government has not yet set out in detail what it wants from the talks, with reported differences between key figures on the balance between free trade and immigration curbs. Mrs May has said she will not trigger Article 50 before the start of 2017 at the earliest.

Hate crime

Image copyright Alamy

Image copyright Alamy There’s clear evidence of a spike in hate crime since the 23 June ballot. Reported hate crime rose by 57% in the four days after the referendum, police say.

Some 3,219 hate crimes and incidents – alleged to have taken place between 16-30 June – were reported to police forces across England, Wales and Northern Ireland, according to revised figures published by the National Police Chiefs’ Council. This represented a 37% increase compared with the same period in 2015.

The next reporting period, from 1-14, July, saw 3,235 reports of hate crimes and incidents. This was up only 0.5% on the previous fortnight but it was still a 29% increase on the same period in 2015.

And 15-28 July saw 3,236 reports – virtually unchanged on the previous fortnight and up 40% on the same period the previous year. Police Scotland, however, has said this rise in reports has not been witnessed north of the border.

It’s impossible to tell to what extent the spike was about a rise in reporting and to what extent it was about a rise in actual incidents. What we do know is that most hate crimes typically go unreported. The government has announced a plan to tackle hate crime in England and Wales and police handling of such incidents will be reviewed.

House prices

Image copyright Getty Images

Image copyright Getty Images When it comes to buying a home, there is some evidence that buyers have been discouraged by the Brexit vote.

August did see a “slight pick-up” in house price growth with prices up 5.6% on the year, according to the Nationwide. But this is probably because while fewer of us may be in the market to buy homes, fewer of us are also selling.

The number of homes for sale is at near 30-year lows, which is why the pace of house price growth has remained broadly stable. It’s a view backed up by Bank of England figures showing the number of new mortgages being approved by banks and building societies falling to its lowest for a year and a half in July.

This is in contrast to data published earlier from the Council of Mortgage Lenders (CML). But it is possible the Bank’s figures, which are more forward-looking, may give a more accurate indicator of the current housing market.

Looking ahead, there are expectations that UK house prices are set to fall in the short term as the market pauses for breath, before rising once again.

The above chart from the Royal Institution of Chartered Surveyors (Rics) shows that on balance their respondents expect prices to fall over the next three months, while they expect them to rise over a 12-month period.

It’s a clearer story when it comes to commercial property. Demand for London office space has bounced back from a pre-referendum dip, according to the commercial property firm CBRE. The amount of space being taken by firms in the capital rose to almost a million square feet in July, up 24% on June.

Migration

All the figures on numbers of people coming to the UK date from before the Brexit vote happened.

In the year to March net migration – the difference between the number of people coming to the UK for at least a year and those leaving – remained at near record levels, at 327,000. But this was slightly down on the previous year.

The figures showed a slowdown in the numbers settling in the UK from Poland and seven other Eastern European countries – but that was offset by an increase in net migration from Bulgaria and Romania, which hit record levels of 60,000.

Trade

Image copyright Getty Images

Image copyright Getty Images Figures from the ONS suggest that the fall in the value of the pound since the vote has increased the cost of imports for manufacturers. Input prices faced by manufacturers rose 4.3% in the year to July, compared with a fall of 0.5% in the year to June. The most dramatic rises came in the costs of imported food materials and metals.

Britain has long been running a trade deficit, meaning that overall we import more than we export.

The chart below shows that we do sell more services abroad than we import – but this is not enough to counter the bigger deficit in the value of the goods we sell abroad, compared to the value of the goods we import.

In the month of the referendum, Britain’s trade deficit widened to 5.1bn after imports hit a new high.

A weaker pound may help exporters cut some of this deficit as their products will now be cheaper, but it could also cause inflationary pressures in the UK as it will put up the costs of imports and raw materials.

Construction

Image copyright Getty Images

Image copyright Getty Images The UK’s construction industry seems to have recovered in August from a downturn that started just before June’s Brexit vote. The latest Markit/CIPS UK Construction Purchasing Managers’ Index rose to 49.2 from 45.9 in July, although the figure is still below the 50 mark that divides expansion from contraction.

The uncertainty over what happens next has acted as a brake on the construction sector during August, especially in terms of house building, the survey suggests. However, a number of firms say that sales have held up better than had been expected.

Significantly these figures also indicate the sector has seen a further steep rise in the cost of raw materials, with input costs now rising at their fastest pace since July 2011.

The Mineral Products Association, which represents firms making products such as asphalt and cement, said its figures pointed to an upturn in the three months ahead of the referendum but that activity was expected to flatten over the next 18 months.

Jobs

Image copyright Getty Images

Image copyright Getty Images Total UK unemployment dropped between April and June in the run-up to the vote, with the jobless total down by 52,000 to 1.64 million – leaving the unemployment rate at 4.9%. But little of the data covers the period since the vote, so it’s not yet possible to draw any conclusions about the referendum’s impact.

Elsewhere, a Markit/REC survey suggested the jobs market suffered a dramatic slowdown in July, with permanent hiring dropping to levels not seen since the 2009 recession.

When it comes to individual firms the picture is mixed.

The world’s biggest security firm, G4S, warned that the UK’s workforce and economic growth might shrink, and one of Britain’s biggest banks, Lloyds, has accelerated its job cuts, axing a further 3,000 posts – although it said it had made this decision before the referendum.

Elsewhere Japan’s Softbank said it was buying the UK microchip-maker ARM Holdings for 24bn, and would double the number of staff in five years, pharmaceuticals firm GlaxoSmithKline is investing 275m in the UK, while McDonald’s is creating 5,000 new jobs.

Read more: http://www.bbc.co.uk/news/business-36956418