Albert raises $2.5 million for its finance app that helps you save money

Everyone knows the basics of how to improve their financial health: put money into savings, track your spending, reduce your debt, look for ways to save on your monthly bills, and make smart investments. Where people struggle is translating that knowledge into specific actions you can take today. Thats where an application called Albert steps into help. The startup, which has now closed on $2.5 million in seed funding, offers a simpleway to track your finances as wellas personalized recommendations aimed at boostingyour overall financial standing.

The funding comes from Bessemer Ventures Partners, CFSI (Center for Financial Services Innovation), 500 Startups, and 500 Fintech, and others. It arrivesshortly after the apps launch earlier this summer.

Albert was co-founded by former college friendsYinon Ravid and Andrzej Baraniak, who both previously held careers in financial services.

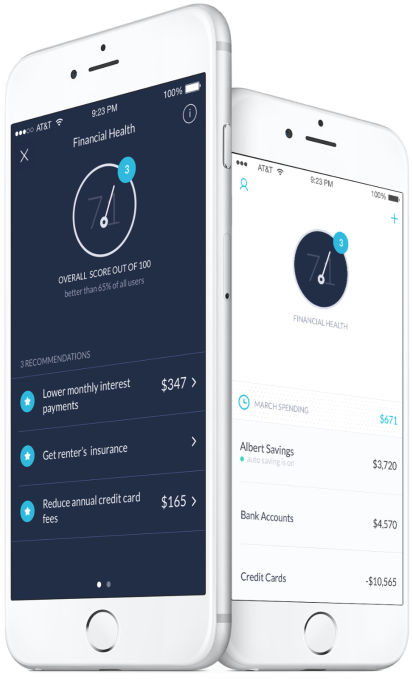

Aimed largely at younger, mobile users, Albert is not a mobile banking application, like Simple. If anything, it operates more like Mint, in the sense that it aggregates your financial data into a single destination, including bank accounts, credit cards, property, loans and investments.

Where it differs from a service like Mint is that its more narrowly focusedon offering financial adviceand encouraging you to make changes, while also helping you track your everyday spending and budget.

And whenit offers tips, it pushesyou to actually put them into action.

For example, Albert may suggest that you need to start a savings account.

The vast majority of people between the ages of 20 and 40 dont actually save money they actually spend more than theyve earned in the last three months, explains Ravid. So one of the first pieces of advice we give is to save a few dollars to grow your emergency fund.

Albert thenhelps you get this fund started by transferring moneyautomatically from your bank Albert Savings, its FDIC-insured savings accountthat lives directly in the app.

This idea of automating your finances is something several other mobile apps in the broader fintech space have also implemented, like savings apps Digit or Qapital and investing apps like Stash Invest and Acorns. Meanwhile, in terms of offering a birds-eye view of your finances, Albert is up against apps like Level Money or Prosper Daily. Others still, like LearnVest, aim to teach you how to take charge of your finances by offering personal advice.

Albert, however, takes all those concepts and places them into a single destination.

In addition to helping you save, Albert may also suggest things like applying fora lower-interest loan to pay off credit card debt, reducing your car insurance payments by changing insurers, or making investments.

To make theserecommendations, Albert works with partners and this is also how it makes money. The company has relationships with lenders who will offer loan quotes, while it turns over investment advice to Betterment, and it works with CoverHoundto provide insurance quotes. Albert generates revenue from these referrals, which is how it keeps its app free for consumers.

While that also means Albert is outsourcing a lot of the heavy-lifting in terms of the advice it offers, that helps to keep its suggestions unbiased, notes Ravid.

One of the things we think is very important in giving people advice and improving their financial health is staying objective and staying at arms length from the services we recommend, he says.

Beyond its advice, Albert also notifiesyou when important things happen with your money like youve gotten an overdraft fee, or a bill is coming due. And it has a variety of tools that let you view your spending, bills and income, to give users a reason to interact with the app on a regular basis, even after theyve taken action on Alberts tips.

Ravid wouldnt talk about how many users Albert has, but its app is now ranked #84 in the Finance category on the iTunes App Store, where Apple has been regularly featuring it in recent days. The co-founder would say that the volume of data Albert is tracking is growing, and it now tracks over 50 million transactions.

The L.A.-based startup is a team of four, and recently rolled out version 2.0 of its app in advance of its plans to launch on Android. The app is a free download on the App Store.