Age gap among first-time buyers sets in, the Halifax says – BBC News

Image copyright Thinkstock

Image copyright Thinkstock A gap between the average age of first-time buyers in different parts of the UK has set in despite property price growth slowing, a lender has said.

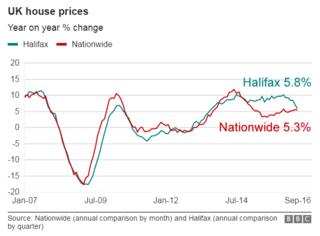

The Halifax said that UK property prices rose by 5.8% in September compared with a year ago.

This offers some cheer to first-timers who faced annual rises in house prices of 10% six months ago.

Yet those buying in the priciest parts of the UK were typically seven years older than those in cheaper areas.

The Halifax said that the youngest first-time buyers were in Carlisle in Cumbria and Torfaen in south Wales where they bought at an average age of 27. The oldest were in Slough in Berkshire as well as Barnet and Ealing in London where the average age was 34.

Overall in the UK, the lender said the average first-time buyer was aged 30.

Most are likely to be looking for properties a lot cheaper than a 14m mansion that has just been sold in south London or a typically priced home in the UK which, according to the Halifax, now costs 214,024.

‘Downward trend’

Property values rose by 0.1% in September compared with August, according to the Halifax figures which are based on its own lending figures.

However, they fell by 0.1% in the three months to the end of September compared with the previous quarter.

Year-on-year, house prices were still rising but at a slower pace, said Martin Ellis, housing economist at the Halifax.

“The housing market has followed a steady downward trend over the past six months with clear evidence of both a softening in activity levels and an easing in house price inflation,” he said.

He added that house prices had risen faster than earnings for some time, which had reduced demand among buyers.

However, a shortage of properties in the market meant that prices were still going up.

Ben Madden, managing director of the estate agents Thorgills, said: “The collapse in the market many predicted simply has not materialised and the reason for this is the acute lack of supply, exceptionally low mortgage rates and an economy and consumer that, as yet, appear to be holding up despite the political uncertainty.

“It is nevertheless a peculiar and uncertain market. Generally speaking, buyers feel it is their market, but the longer the economy holds up in the aftermath of Brexit the more the market may begin to favour sellers.”

Martin Tett, housing spokesman for the Local Government Association, said: “The shortage of houses in this country is a top concern for people who are finding that buying their first house is increasingly out of reach.

“Councils support measures to boost home ownership. But not everybody is ready to buy, and a renaissance in council housebuilding is needed to ensure there is a mix of homes – to rent and buy – that are affordable for those people that need them and that are crucial for enabling people to save money towards a deposit.”

A week ago, the Nationwide Building Society said annual house price inflation has fallen, from 5.6% in August to 5.3% in September.

It said housebuilders should get on and build more houses with the number of homes on the market close to record lows.

Read more: http://www.bbc.co.uk/news/business-37583882