Silicon Valley boardrooms are becoming a mess of conflicted interests

Oracle Corp.s biggest cloud-computing takeover is in peril, partly the result of an investment made by Larry Ellison 18 years ago in what was then a little-known startup.

That company became NetSuite Inc., the cloud-computing provider that Oracle is now trying to buy for $9 billion and whose biggest outside shareholder opposes the deal. T. Rowe Price Group says Oracle isnt paying enough and that the transaction is rife with conflict for Ellison, Oracle chairman and NetSuites biggest investor. “The inherent conflicts of interest between NetSuite, the Ellison entities and Oracle are daunting and may be impossible to manage,” T. Rowe Price recently lamented in a letter to Oracle.

Early startup investing by wealthy executives abounds in Silicon Valley, leaving boardrooms packed with possible conflicts and boosting the likelihood of disputes like the one threatening Oracles acquisition. The concern is that shareholders will end up on the wrong side of clubby deals or left in the dark altogether in cases where executives arent required to disclose holdings. The rise in angel investing and investments by board members in venture-capital-funds over the past 10 years has significantly increased the frequency of this type of potential conflict,” said David Lipkin, a lawyer at McDermott Will & Emerys Silicon Valley office. Oracle declined to comment.

In 2013, the number of seed and angel rounds began topping 1,000 a quarter, up from about 400 in 2010, according to the National Venture Capital Association. A 2013 change in regulations led to the rise of angel-investing syndicates through organizations such as AngelList, helping drive seed investments to near 1,400 a quarter in the second half of 2014 and most of 2015.

To avoid the appearance of a conflict, some companies ask independent board members to review deals involving a company official, or they require directors or executives to recuse themselves from discussions of deals involving a company in which they have an interest.

Mapbox is a startup that helps developers build digital maps and whose early backers include DBL Partners managing partner Ira Ehrenpreis. Hes also a board member at Tesla. Last year, Tesla agreed to pay Mapbox $5 million to work on a project for a year. Tesla said in a filing that Ehrenpreis avoided the negotiations and that he had no “direct or indirect material interest in the transaction. Ehrenpreis didnt respond to requests for comment, but Tesla said its policy “is to have any related-party transactions run through independent members of its audit committee before they get approved.”

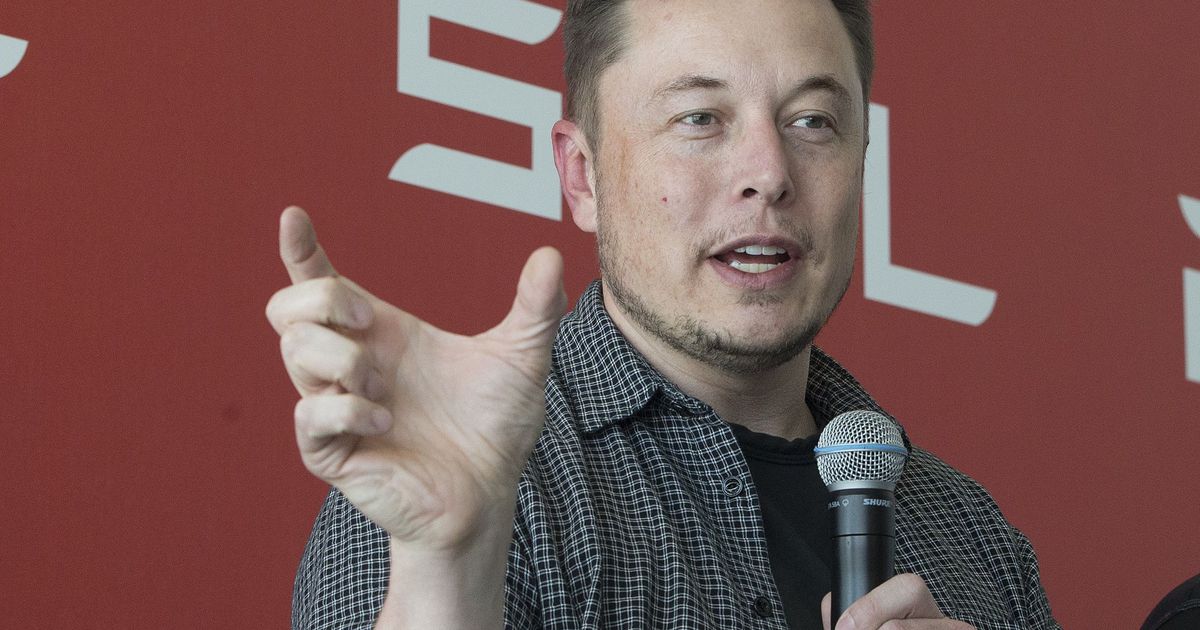

Tesla has drawn fire for potential conflict involving its bid for SolarCity Corp. Tesla Chief Executive Officer Elon Musk is chairman of SolarCity, which is run by his cousin, Lyndon Rive. While Musk has said he will sit out board negotiations on the deal, six of seven Tesla directors are Musk insiders with SolarCity ties. Thats prompting some investors to push for a boardroom shakeup at Tesla.

Salesforce CEO Marc Benioff is a prolific angel investor, and the company has bought some of the firms hes backed, including Quip and artificial intelligence startup MetaMind. “We have a strong governance process for our investment and M&A activity to avoid potential conflicts of interest,” said Salesforces John Somorjai, executive vice president of corporate development and Salesforce Ventures.

Too Incestuous

For public company acquisitions, the Securities and Exchange Commission mandates disclosure of conflicts in certain cases, such as if the acquiring companys director owns more than 10 percent of the target company, and the transaction is more than $120,000.

Rules are less stringent for private companies. Under Delaware corporate law, which governs many U.S. companies, conflicted board members dont necessarily have to recuse themselves from discussions though many do to avoid the appearance of impropriety, Lipkin said.

Many investors view recusal as best practice, a preemptive move aimed at defusing criticism. Even so, the groundwork for many deals is laid long before any formal boardroom discussion, said entrepreneur and technology academic Vivek Wadhwa, a former director at contact-management company Humin. Informally, there are lots of conflicts of interest, he said. Its too incestuous. He decided last year he wouldnt take full board seats at Silicon Valley companies because of this reservation, although he still advises a handful of startups as a board observer.

Acquisitions can grow awkward quickly when angel investments are involved, according to the former head of business development for a large technology company that frequently bought companies backed by its CEO. Low-ball bids left the CEO open to criticism for overpaying for the earlier stake, said the person, who asked not to be identified discussing sensitive topics. Once or twice, startup founders complained to the CEO, who in turn asked the business development team to re-evaluate, creating pressure to raise the price, the person said. He often tried to pass such transactions on to more junior colleagues.

At one startup, multiple conflicts created a farcical situation. The firm was negotiating a supplier agreement that was so important the board had to consider it. As the discussions started, all the board members except one had to recuse themselves because they had personal angel investments in the supplier, another startup, according to one of the board members. That director said he ended up evaluating and approving the deal alone. He asked not to be identified because the deliberations were private.

Larry Specials

In cases where the executives stake is small, even publicly traded companies arent required to disclose would-be conflicts. Last year, Twitter Inc. paid $479 million in cash and stock for online marketing startup TellApart, in which then-CEO Dick Costolo had a small personal stake. Twitter didnt disclose the investment in regulatory filings, but when asked by reporters about the stake, the company said Costolo hadnt taken part in board decisions about the deal. A Twitter spokesman declined to comment.

Angel investor Chris Sacca found himself on both sides of a deal in 2011 when Twitter, in which he invested early on through his Lowercase Capital fund, tried to buy ad-tech startup AdGrok, which he also backed. Despite ostensible loyalties to Twitter, Sacca advised AdGrok, advocating a high sale price, former AdGrok CEO Antonio Garcia Martinez wrote in the book “Chaos Monkeys.” “If and when I sell one company to another portfolio company, the conflicts are made clear to everyone and each side signs off,” Sacca said. “Usually the bigger company okays me helping advise the smaller company, who is less likely to have another advocate on their side.”

At Google, co-founders Sergey Brin and Larry Page have made early startup investments for years, and Google has occasionally bought companies they backed. Take wind-turbine company Makani, which Page invested in after meeting one of its founders at a kite-surfing competition, according to a person familiar with the situation. Googles venture arm invested in the company in 2008, and in 2013 Google itself bought Makani for an undisclosed sum.

Genome research company 23andme Inc., founded in 2006 by Brins then-wife Anne Wojcicki, was also backed by Google. Internally, executives called investments funded by both the company and personally by one of the founders Larry Specials or Sergey Specials, the person said. He asked not to be identified speaking about private investments. A Google spokesman declined to comment.

Taking a stake in a startup isnt necessarily about executives enriching themselves. Its often other factors, such as ego, relationships and preserving collegiality in the boardroom, said Norman Bishara, a professor of business law and ethics at the University of Michigan.

For some, the benefits of investing in up-and-coming businesses outweigh the risk of conflicts. By backing a startup, executives can keep tabs on emerging technology that could help or destroy the companies they run. Quips work-collaboration technology has turned up in new products launched by Salesforce, for instance.

I hesitate to focus on the downside,” said Barry Kramer, a lawyer at Fenwick & West, referring to angel investing and occasional ensuing conflicts. I view it as an adverse side effect of something really good.

- Hong Kong Home Prices Set to Plunge on Policy Change

- U.S. Stock Futures Jump as FBI Letter Seen Aiding Clinton Chance

- Hedge Funds Are Hiding Out in Gold

- Sun Hung Kai, Henderson Fall in U.S. After Property Curbs: Chart

This article originally published at Bloomberg here

Read more: http://mashable.com/2016/11/03/silicon-valley-boom-breeds-conflict/